Eat The Rich - A Series - Part Two

Last week in part one of “Eat The Rich” was very well received, and I’ve been writing on this topic for the past few weeks, so let’s keep the hits coming.

We got more replies, forwards, and long thoughtful notes than we expected, and as any good entrepreneur would do, we’re going to explore this interest and momentum with Part 2: Washington’s Legal Wealth Tax Fight

If you believe someone in your circle (friends, family, or colleagues), would get value from this newsletter, do them a favour and send them this link to subscribe.

⏳️ Estimated Read Time: 5 minutes

Was this email forwarded to you? Subscribe here.

Washington’s Legal Wealth Tax Fight

The "Bezos Exit" was the signal; now comes the noise. When Jeff Bezos traded the rainy shores of Lake Washington for Florida’s sunshine, the narrative was about family. But for the "smart money" in the Pacific Northwest, it was about reading the tea leaves of a state undergoing a fundamental personality shift.

On December 23, 2025, Governor Bob Ferguson—inheritor of a 41-year Democratic gubernatorial (State Governor in power) streak—unveiled his "Millionaire’s Tax."

It is a 9.9% levy on annual income exceeding $1 million. While billed as a "rebalancing" of an "upside-down" system, the proposal serves as a high-stakes stress test for Washington’s business-friendly identity.

The Math of a Managed Decline

Washington’s fiscal ship is taking on water, but the leak isn’t a lack of revenue—it’s a lack of restraint. Despite a $78 billion budget passed in May, the state faces a $1.5 billion deficit for the current cycle and a looming $4.3 billion hole for 2027–29.

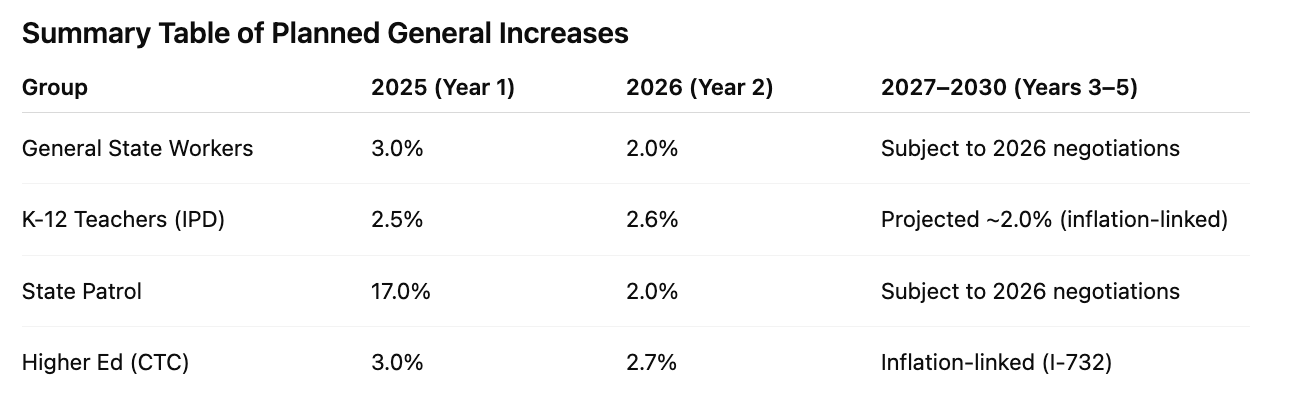

The irony? While the state mandated 1.5% "efficiency cuts" across agencies, the Public Sector Wage Paradox tells a different story:

Ratified Raises: Most general government workers secured 3% increases in 2025 and 2% in 2026.

Specialty Spikes: The State Patrol saw a staggering 17% jump this year.

The "Step" Trap: Roughly 70% of state employees receive automatic 5% "step increases" regardless of inflation or budget health.

When wages grow at 3–5% while "cuts" are framed at 1.5%, the deficit isn’t a short term challenge, it’s a long term compounding chasm.

The Millionaire’s Tax: Mechanism and Motive

Unlike the stalled "Wealth Tax" (HB 1319) that targeted net worth, Ferguson’s proposal is a surgical strike on realized annual income.

The Target: Less than 0.5% of the population.

The Carrot: $3 billion in projected annual revenue to fund K-12 and offset B&O taxes for small businesses.

The Reality: Revenue won't materialize until 2029, leaving a four-year "bridge" of uncertainty for the state’s high-net-worth (HNW) residents.

Total Revenue Share: Given that Washington’s annual General Fund revenue is roughly $40 billion, the Capital Gains Tax alone (paid by the ultra-wealthy) accounts for about 2.5% to 3% of the total state budget.

When adding their share of sales and property taxes, estimates suggest the top 1% contributes roughly 13–15% of all state tax revenue.

Why is it ok in society to select one group of people and treat them differently?

What are the values of equality which I believe are front a center in the constitution all people should be treated equally?

Is this even legal?

Constitutional Gymnastics

This is where "equal treatment" becomes much stricter. Washington’s Constitution contains Article VII, Section 1, known as the Uniformity Clause. It says:

"All taxes shall be uniform upon the same class of property..."

In Washington, this clause is the primary reason they do not have a state income tax.

Here’s why:

Income = Property: In a landmark 1933 case (Culliton v. Chase), the Washington Supreme Court ruled that income is property.

AND

The "Same Rate" Requirement: Because income is property, the Constitution requires that it be taxed uniformly. This means if the state taxes income at all, it must tax everyone at the exact same percentage (e.g., a flat 1%).

BUT

The "Millionaire Tax" Conflict: A tax that only hits people making over $1 million (a graduated tax) would treat one "class of property" differently than another, which violates this specific "equal treatment" rule in our state constitution.

The Investor’s Verdict

For decades, Washington was one of seven "tax havens" without an income tax.

That status was a powerful recruitment tool for the titans of tech and research. If the Millionaire’s Tax passes, the "personality" of the state is effectively divorced from its founding economic principles.

In a world of remote work and mobile capital, the question isn’t whether the rich should pay more—it’s whether they will stay to do so. With a 15% revenue share already coming from the top 1%, even a minor exodus could turn Ferguson’s "Golden Bullet" into a self-inflicted wound.

Hear the Pitch from the Horses Mouth here:

Larry and Sergey from Google are out, David Sacks, Thiel, etc and the All In pod this week shared more details about the proposed billionaires tax (Read Seizure) and how trillions have preemptively left the state on California.

Some great posts from the Fountain Community

Gary Vee breaks down consumer trends, and more. A lot of focus on written content.

Reveals from CES you’ll want to pay attention too.

Interesting way to use AI in the interior design niche. Love this innovation.

I also invited David MacDonald from the Center for Canadian Policy Alternatives to have a discussion and an interview about his authored piece on CEO pay you can read it here.

Hopefully David will accept my invite and we can have a thoughtful conversation about tax for the community to inform your views.

Thanks to everyone, allowing us to dive into our interests while keeping it true to The Fountain.

If you know anyone at Barron’s, WSJ, or Financial Post - hit me up - would love to amplify the “Eat The Rich” while I’m researching and writing. Please connect me - Do your thing Fountain Community.

Hope you are off to a great start in 2026.

Thanks for being here and we hope to keep bringing more stories, interviews, and entrepreneurial jewels to be shared in the coming weeks.

Putting a hand of positivity on your shoulder.

Trent & Ria